Detailed LHCM Review

| 🏦 Broker | LHCM |

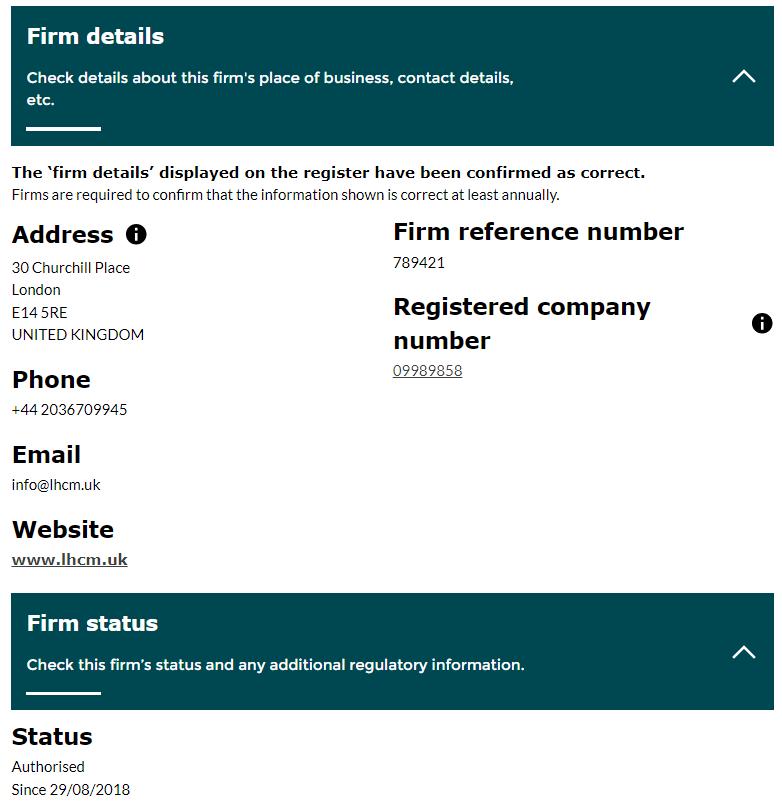

| 🧾 Licenсe | Company number 09989858 |

| 🌐 Website | lhcm.uk |

| 💰 Minimum deposit | 10 000 £ |

| 👮 Regulator | FCA |

| 🗓 Year of foundation | 2016 |

| 💱 Financial instruments | 1 000 000+ |

Overall company rating

-

Reliability

-

Platform

-

Commissions

-

Support

-

Financial instruments

Quick overview:

LHCM Ltd. is licensed by the FCA to provide trading services to professional clients under the EXANTE trademark. In this LHCM broker review, we’ll look into the features of the Exante trading platform, its trading instruments, pros and cons, trading fees, and more.

Key takeaways

- In 2018 LHCM Ltd was authorized/licensed by the Financial Conduct Authority (FCA) to carry out regulated financial service activities.

- The Exante trading platform offers access to over one million financial instruments.

- The Exante brand is used as a trademark for several licensed investment firms around the world in the UK, Malta, Cyprus, and Hong Kong.

- Serves investors in more than 100 countries

- Ideal for experienced investors looking to trade across multiple asset classes

Pros

- Trade 1 million+ financial instruments with a single multi-currency account

- Trading instruments include stocks, ETFs, bonds, and more

- Accounts available for professionals and eligible counterparties

- Competitive rates and a transparent fee structure

- Web, mobile, and desktop trading platforms available

Cons

- The minimum deposit amount of 10,000 EUR/GBP may be high for smaller investors

- A fixed withdrawal fee of EUR 30

- No option for third-party indicators on the terminal at the moment

Full Review

LHCM

Minimum deposit

10 000£

A minimum deposit of 10,000£ is required to open a brokerage account.

Withdrawal fee

€30

Regardless of withdrawal amount

LHCM LTD is authorized and regulated by the Financial Conduct Authority (FCA) in the UK and the broker operates within strict ethical and financial standards to provide peace of mind to traders about the safety of their investments. Exante is also GDPR compliant, adhering to stringent data protection laws and preventing the misuse of personal data.

Note that LHCM LTD does not currently accept customers who are classified as Retail.

The Exante trademark is owned and licensed by XNT LTD, which has granted LHCM LTD the use of the trading name. The platform is available for traders on the web, desktop, and mobile.

Exante serves traders in over 100 countries and has more than 1.6 billion AUM. Its clients include private investors, banks, and wealth managers, and LHCM offers the Exante platform to clients, with access to financial instruments like stocks and ETFs, bonds, futures, options, currencies, and funds.

Trading instruments

Stocks and ETFs

The Exante trading platform offers access to over 30,000 stocks from global exchanges, and it also offers access to a unique range of ETFs for all purposes, whether you’re looking for safe investment opportunities or prefer high-volatility investments.

The availability of ETFs provides an added layer of diversification, allowing for broader market exposure. With commission fees starting as low as 0.01%, traders can take advantage of equity market opportunities and build a diversified portfolio.

Bonds

Investors can trade thousands of bonds through the Exante platform. Bond traders can access corporate and government bonds with straightforward fees starting from 9 bps.

With a custody fee of 0.3% per annum, traders can explore opportunities in the fixed-income markets and potentially earn steady returns. Traders get access to prime bonds and unlimited opportunities for portfolio diversification.

Futures

The Exante trading platform offers robust futures trading capabilities with competitive fees and access to commodities and financial instruments, allowing traders to leverage futures contracts to their advantage. LCHM broker offers 500 types of futures contracts on its trading platform; whether it's currency, oil, or indices futures.

Exante provides access to global markets such as LSE, HKEX, and Eurex, and offers traders access to global futures exchanges with 100% real-time prices and fast execution times.

Options

Exante offers hundreds of thousands of options contracts on futures, stocks, indices, and interest rates, and the platform facilitates a range of options strategies. Traders can use this to implement various investment strategies and capitalize on market movements.

Funds

LHCM, through the Exante trading platform, offers a variety of professionally managed investment funds, such as hedge funds and mutual funds. This allows investors to strategically allocate their assets and manage risks, making it ideal for those who prefer a more hands-off approach or want to diversify their portfolio.

Currencies

Exante’s offerings are equally impressive, with over 50 currency pairs available and live market spreads starting at 0.2 pips. Whether it's major pairs like EUR/USD, or minor pairs, the platform's competitive spreads and leverage options make it a good choice for currency traders. Investors benefit from a safe forex trading experience, 100% reliability, and fast execution.

Metals

Investors who wish to trade precious metals can access the trading platform to buy and sell metals like gold, silver, and platinum. The platform charges low commission fees of 0.005% per trade, which allows traders to take positions in these markets and diversify their portfolios.

Funds

The platform has over 200 funds available, with online access to hedge funds with the Hedge Fund Marketplace. Investors can monitor positions in real-time, and invest in funds with a single click.

Trading platform

Web

With Exante's web-based trading platform, clients can execute trades from any web browser without having to download any software and it doesn’t rely on your browser and HTTP protocol. The platform also allows for a lot of customization with its modular design and user-friendly interface.

One popular module is the Basket Trader, a tool that allows you to handle a portfolio of assets at once. You can buy or sell a group of financial instruments simultaneously and set the number of units for each instrument. Also, you can select the side of the trade, whether it is buying or selling.

The Bond Screener is another powerful module that lets you find bonds and filter them by multiple criteria simultaneously. You can personalize your search results, and add or remove columns to filter the most important information. The platform has stringent security measures, with data encryption and secure login procedures ensuring the protection of clients’s data and transactions.

One drawback worth mentioning is that the platform doesn’t currently support third-party or custom indicators, which could potentially be a limitation for some traders.

Desktop

Traders who prefer a comprehensive trading experience can use Exante’s desktop trading platform, which offers a wide range of trading tools and features. It has advanced charting capabilities, and an extensive range of technical indicators, with a modular design for plenty of customization.

The trading platform is highly reliable with rapid execution speeds and supports multiple chart types and time frames. Experienced traders can create and save multiple workspace layouts, making it easier to switch between different setups.

It also has a quick search function and drag-and-drop features. Exante’s trading platform places high emphasis on security, with advanced encryption protocols and secure login processes to safeguard transactions and user data.

Mobile

Available on iOS and Android, Exante’s mobile trading app has a user-friendly interface and allows clients to access all financial products from a single account. The mobile app provides real-time market data, portfolio management, and the ability to execute trades with just a few taps.

It has robust charting capabilities, including a variety of time frames and technical indicators for traders to use. Similar to the desktop version, the app prioritizes security, with two-factor authentication and automatic logouts to protect sensitive information.

Fees

Exante only charges fees for actual trades, with the minimum trading unit size varying by instrument. Transparent fee information is available on their website.

Fees for trading stocks and ETFs vary depending on the exchange. When trading on US exchanges the maximum rate per share is USD 0.02. European exchanges charge varying fees ranging from 0.02% to a maximum of 0.18%. For Asian exchanges, fees range from 0.1% to 0.1927%.

These rates are accurate as of January 2024. For the latest fee schedule, click here.

Note that for short positions and FX, overnight fees are applicable, and these are constantly changing based on market conditions. Clients can find updated overnight fees in the Client Area.

Some other fees that may apply include a 90 EUR fee for manual executions (phone or email orders) and a 0,3% annual custody fee for bonds. For shorting stocks, the fee is approximately 12% of the transaction value, as an annual rate. There is no margin trading fee as long as the margin utilization remains below 100%.

How to open an LHCM account

Opening an account on the Exante trading platform is easy. Simply visit the LHCM broker website, and click on ‘Open Account’. You will be redirected to the sign-up form, where you can choose between an individual or corporate account.

You can begin with a demo account offering €1,000,000 in virtual currency so you can practice your trading skills and learn how to use the platform.

To customize your account based on your preferences, Exante will request you to complete a questionnaire that includes your trading experience and interests. After that, you will need to verify your identity for either your individual or corporate account.

To complete the verification process, you will need to upload the necessary verification documents, which will take approximately one business day to be reviewed and confirmed. For individual accounts, you will need to provide proof of identity and proof of residence.

Once approved, you can start by depositing money into your account. The minimum opening deposit for individual accounts is 10,000 EUR/GBP and for corporate accounts, it’s 50,000 EUR/GBP.

Conclusion

Exante is ideal for experienced traders, wealth managers, and private investors. Individual and corporate accounts are available, and the platform offers market access to more than one million financial instruments. Compared to other brokerages, Exante offers more tradable instruments, and the tools and features are more complex, and designed with professional traders in mind.

Rating methodology

LHCM's overall rating is a weighted average of several broker experience, commissions, platform, and company reliability. Factors we consider, depending on the category, include:

- Fees and charges

- Technical support

- Account features and limitations

- User-centric technology

- Customer service and innovation.

Stars represent ratings ranging from poor (one star) to excellent (five stars). Ratings are rounded to the nearest tenth.