Detailed XNT Review

| 🏦 Broker | XNT LTD |

| 📅 Company Registration Date | 04-03-2011 |

| 🧾 MBR Registration Code | C 52182 |

| 📃 LEI Code | 635400MMGYK7HLRQGV31 |

| 🌐 Website | xnt.mt |

| 💰 Minimum deposit | 50 000 € |

| 👮 Regulator | MFSA |

| 🗓 Year of foundation | 2011 |

| 💱 Financial instruments | 1 000 000+ |

Overall company rating

-

Reliability

-

Platform

-

Commissions

-

Support

-

Financial instruments

Quick overview:

XNT LTD is registered in Malta and licensed by the Malta Financial Services Authority (MFSA). The company operates according to strict ethical and financial standards, allowing traders peace of mind about the safeguarding of their investments.

- XNT complies with MiFID II (Markets in Financial Instruments Directive), holding company assets separately from client assets, which are held by trusted custodians.

- XNT offers the EXANTE trading platform to its clients, which is available on the web, mobile, and desktop, and serves clients in more than 100 countries. It takes the necessary measures to protect client data and prevent the misuse of personal information. As a European company, XNT is GDPR compliant.

- With a minimum deposit requirement of 50,000 EUR for individual professional clients and 250,000 EUR for corporate accounts, the trading platform typically attracts clients that include seasoned investors, banks, and wealth managers.

- The financial instruments available on the platform include stocks, ETFs, bonds, options, futures, funds, metals and more.

Key takeaways

- Trade 1 million+ financial instruments with a single multi-currency account

- Trading instruments include stocks, ETFs, bonds, and more

- Accounts available for professionals and eligible counterparties

- Competitive rates and a transparent fee structure

- Web, mobile, and desktop trading platforms available

Full Review

XNT

Minimum deposit

50 000 EUR

A minimum deposit of €10,000 is required to open a brokerage account.

Withdrawal fee

€30

Regardless of withdrawal amount

Trading instruments

Stocks and ETFs

The Exante trading platform offers you access to more than 30,000 stocks and a variety of ETFs, providing a greater level of diversification and enabling broader market exposure. With commission fees beginning as low as 0.01%, traders can profit from equity market opportunities and create a diversified portfolio.

Bonds

Through the Exante trading platform, investors can trade thousands of corporate and government bonds with fees starting from 9 basis points. Additionally, there is a custody fee of 0.3% per annum for bonds. Traders can access prime bonds, which can help diversify their portfolios.

Options

XNT offers a variety of options contracts for futures, stocks, indices, and interest rates. The platform supports a range of options strategies, enabling traders to implement different investment strategies and take advantage of market movements.

Funds

The Exante trading platform offers a variety of professionally managed investment funds, such as hedge funds and mutual funds. This allows investors to strategically allocate their assets and manage risks, making it ideal for those who prefer a more hands-off approach or want to diversify their portfolio.

Futures

The trading platform provides clients with a range of capabilities and competitive fees and by trading commodities and financial instruments, you can make use of futures contracts to your advantage. XNT offers 500 types of futures contracts on its trading platform, covering currency, oil, and indices futures.

With access to global markets like LSE, HKEX, and Eurex, Exante's trading platform offers traders the opportunity to trade on global futures exchanges with 100% real-time prices and fast execution times.

Currencies

The Exante trading platform offers more than 50 currency pairs with live market spreads starting at 0.2 pips, making it an excellent choice for currency traders. Whether you prefer major pairs like EUR/USD or minor pairs, the platform provides competitive spreads and leverage options. You can rely on Exante's fast execution and 100% reliability when investing in currency trading.

Metals

Investors can trade in a range of metals on Exante’s trading platform, including gold, silver, and platinum. The platform charges low commission fees of 0.005% per trade, which allows traders to take positions in these markets and diversify their portfolios.

Trading platform

Stocks and ETFs

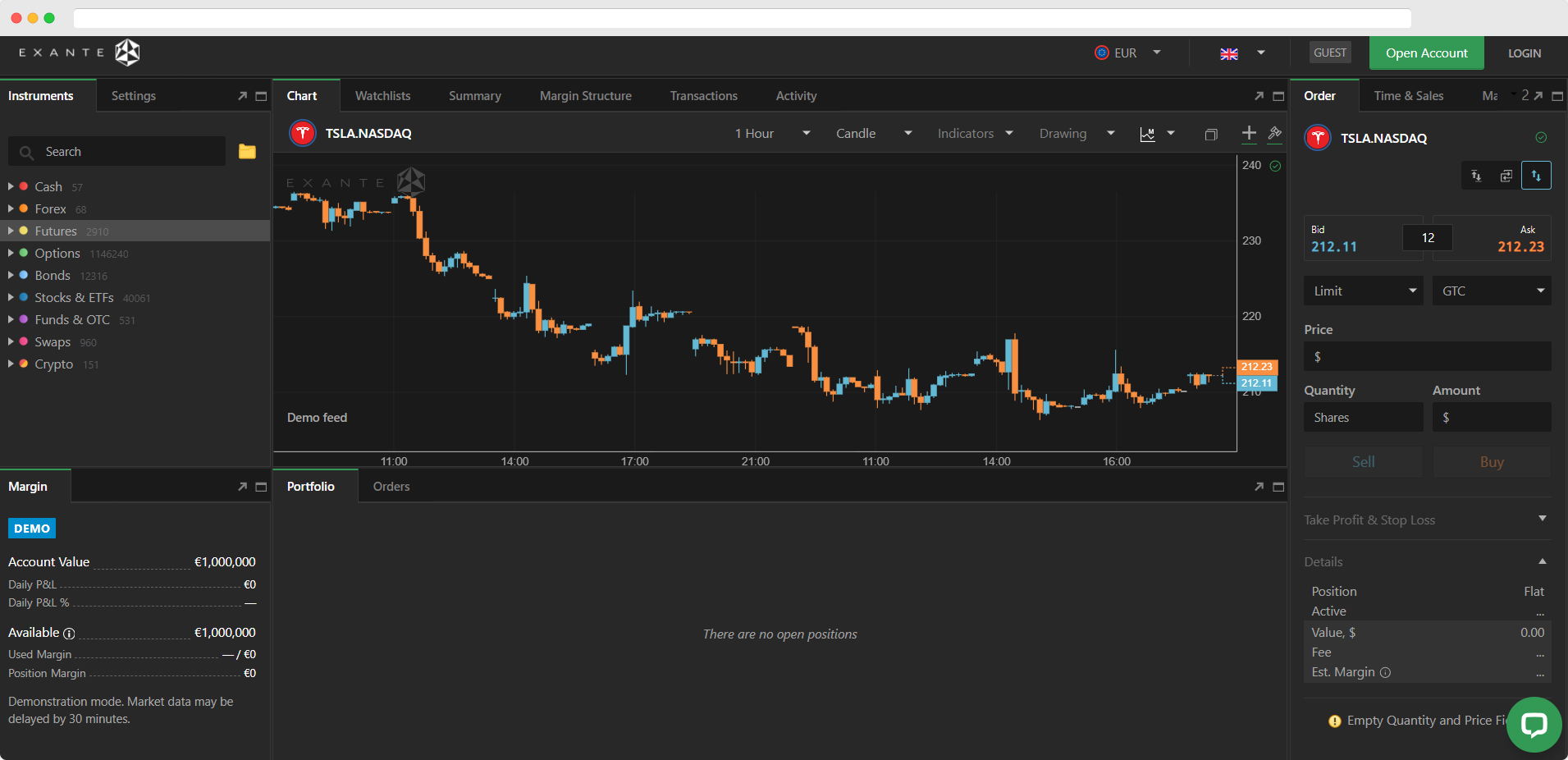

Web

Exante’s web trading platform allows users to easily switch between financial instruments, manage their portfolios, and execute trades. It features real-time data feeds and comprehensive charting tools, so traders can make informed trading decisions.

It has a sleek and user-friendly interface, with a modular design that allows for a lot of customization. With a network of 1,100 servers across the world, Exante’s trading platform ensures the lowest latencies and safe data transfers for traders on its platform.

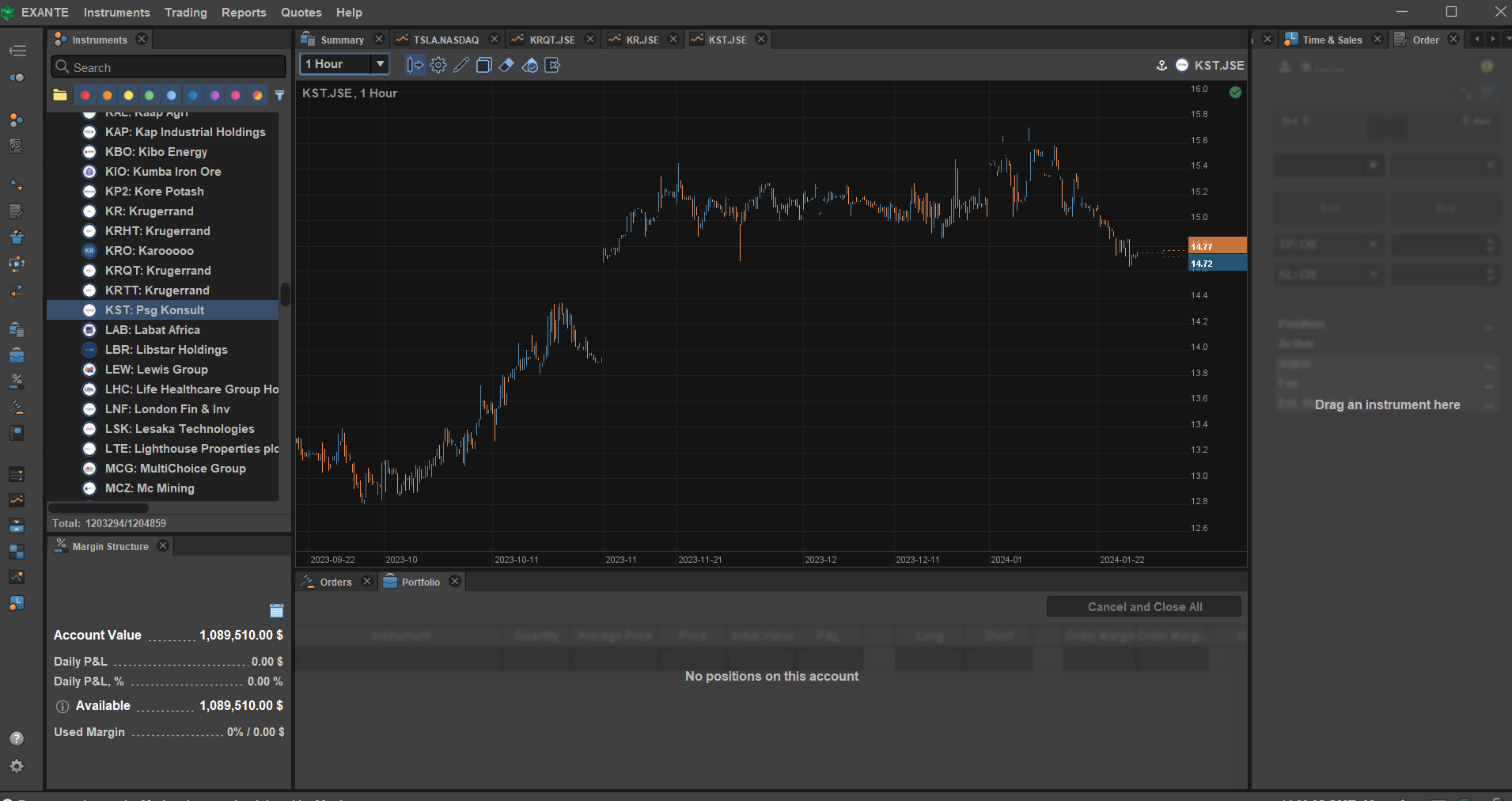

Desktop

The desktop trading platform is a comprehensive trading tool that caters to the needs of professional traders. It provides in-depth trading features and tools that ensure a seamless trading experience and unlike browser-based platforms, it doesn't rely on HTTP protocol, which results in faster trading order processing and eliminates potential delays or connectivity issues.

The powerful desktop trading platform has many customizable features, including modules like the Bond Screener, Basket Trader, and Click-Trade modules.

Another benefit of the desktop version is that it supports multiple chart types and time frames. It offers fast execution speeds and you can save multiple workspace layouts. It has a quick search function and drag-and-drop features, and the platform places high emphasis on security, with advanced encryption protocols and secure login processes to safeguard transactions and user data.

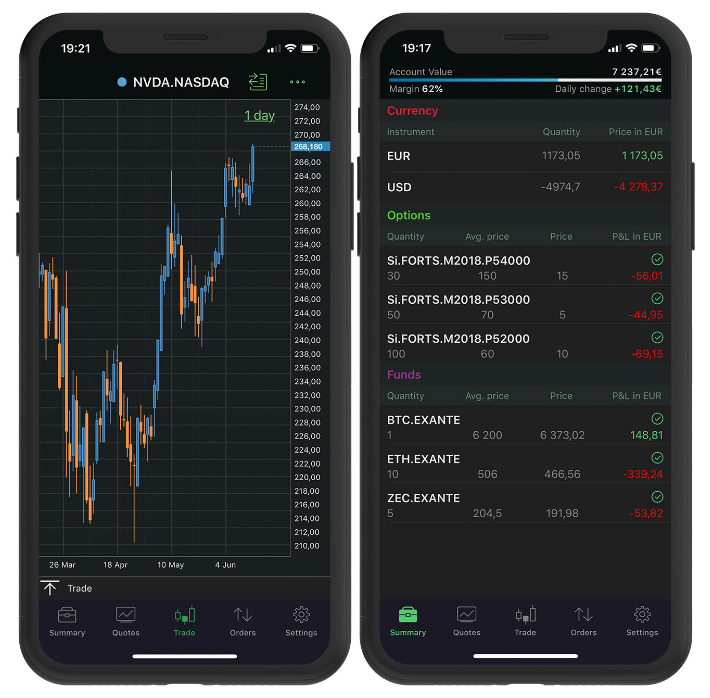

Mobile

Available to traders on Android and iOS, Exante’s mobile trading app has some similar features to the desktop version, with a comprehensive suite of trading tools with a sleek and user-friendly interface.

Traders can look at real-time market data, manage their portfolios, and execute trades with a few clicks. The app is easy to navigate and offers features like a bond screener and basket trader.

Fees

In addition to having a very transparent fee structure, Exante’s trading fees only apply to actual trades. The fees below are updated as of January 2024 and can be found on their website here.

Trading fees

For stocks and ETFs, trading fees on main U.S. exchanges have a maximum rate of USD 0.02 per share. Fees for European exchanges start from 0.02% with a maximum of 0.18%. Trading fees on Asian exchanges vary between 0.1% to 0.1927%.

Futures and options have variable fees based on the exchange. For U.S. exchanges, fees start at 1.5 USD, and for European exchanges, at 1.5 EUR. There is a 0.25% cash conversion fee on all major currency pairs, except EUR/USD, which has a zero fee. For all other pairs, the rate is 0.4%.

Some other fees include:

Deposits and withdrawals

Accounts for individual professionals have a minimum opening deposit of 50,000 EUR and corporate accounts require a minimum opening deposit of 250,000 EUR. Deposits are accepted in various currencies including EUR, GBP, JPY, CHF, CZK, SEK, CAD, HKD, MXN, PLN, NOK, SGD, and AUD.

XNT accepts bank transfers as deposit payments from reputable financial institutions, including tier-1 banks from respected jurisdictions.

When it comes to withdrawals, XNT has two fee structures: standard and non-standard. The standard commission is EUR 30 per withdrawal.

Conclusion

XNT is a reputable investment company that is ideal for seasoned traders, especially as it requires a high minimum opening deposit for individual and corporate professionals. If you’re a professional trader, with a good amount of experience, knowledge, and capital available, then the Exante trading platform could be a viable option with over a million financial instruments on offer.

DISCLAIMER:

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here.

While every effort has been made to verify the accuracy of this information, XNT LTD. cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of XNT LTD. Any action taken upon the information contained in this publication is strictly at your own risk. XNT LTD. will not be liable for any loss or damage in connection with this publication. Costs mentioned herein may increase or decrease as a result of currency and exchange rate fluctuations and are subject to change.